Evaluate. Compare. Decide.

The Definitive Guide to Cell Tower Lease Buyouts

An unbiased resource for property owners evaluating cell tower lease buyout offers before selling.

Buyout Guide →

The Ultimate Cell Tower Lease Buyout Guide

If you’ve received a buyout offer—or expect one soon—this guide will help you understand your lease’s true value, the risks you may not see, and how to make a confident, informed decision.

Written by a specialist who represents property owners in cell tower lease negotiations nationwide.

Cell tower lease buyouts have become one of the most misunderstood financial decisions property owners face. With carriers, tower companies, brokers, and investment firms all making offers, it’s hard to know what’s fair — or what risks you may not be seeing.

At Phone Booth Capital, our perspective is different. We spent years negotiating telecom leases on behalf of the major carriers and tower companies. Today, we use that experience exclusively to help property owners understand the real value of their lease — and avoid costly mistakes.

This guide breaks down everything you need to know to evaluate a cell tower lease buyout with clarity and confidence.

What Is a Cell Tower Lease Buyout?

A cell tower lease buyout is a lump-sum payment made to a property owner in exchange for the rights to receive future rent from their wireless tenant.

“You receive a large upfront payment.

The buyer receives the rent going forward.

You keep full ownership of your property.”

You are not selling your land — only the income stream tied to the lease.

A buyout converts a long-term, uncertain income stream into guaranteed cash today. Instead of waiting 20–30 years to collect rent — with the risk of termination or rent reduction — property owners receive their value upfront and free themselves from future carrier negotiations.

Investors pay a premium for wireless leases because they offer predictable, inflation-adjusted income — making them one of the most sought-after real-estate backed assets in the market.

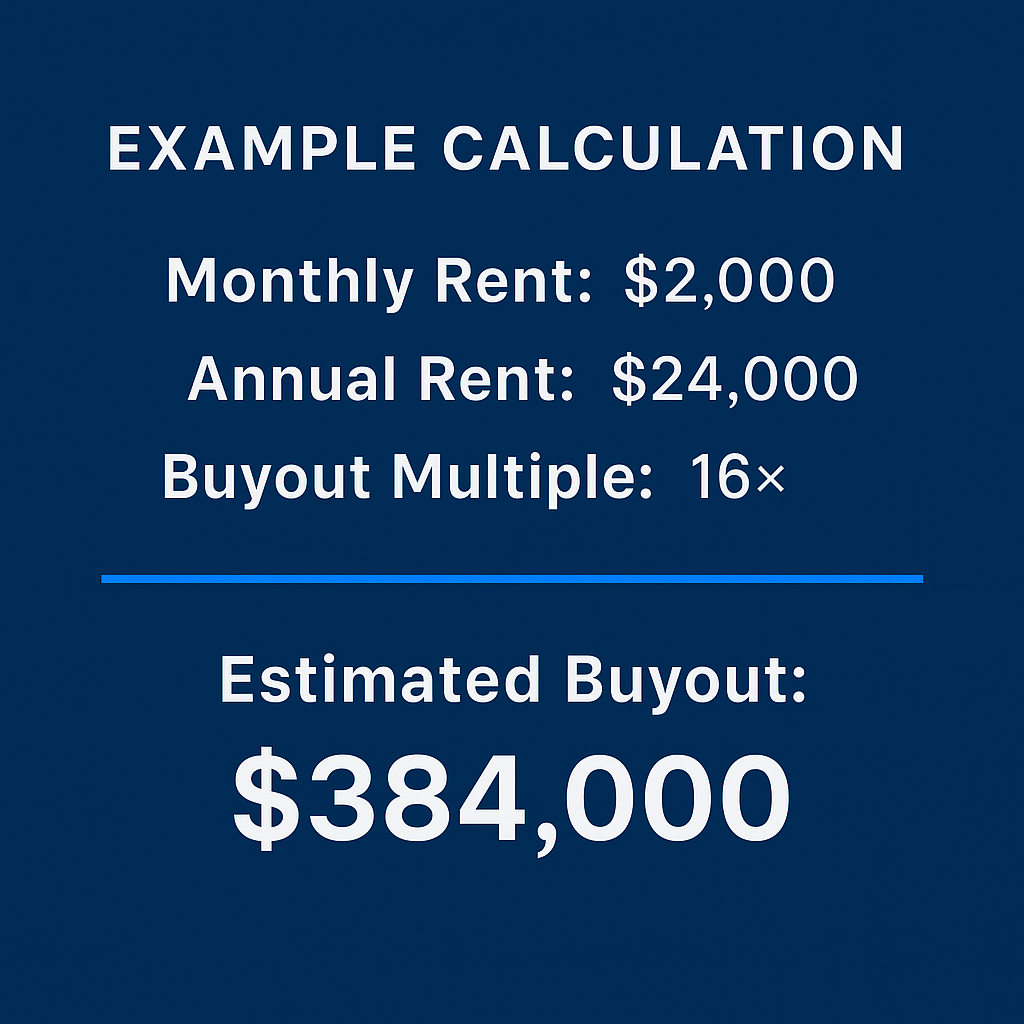

How Buyout Multiples Work

Buyout values are almost always expressed as a multiple of annual rent.

This makes it easy for property owners to quickly understand whether an offer is high, low, or within market range.

What Multiples Really Represent

While multiples are simple to understand, they are actually the surface-level number. Behind the scenes, buyers rely on more sophisticated financial models to determine how much they can pay. Most institutional investors evaluate wireless leases using a blend of:

Multiples (a quick comparison metric)

Cap rates (a measure of risk vs. return)

Internal Rate of Return (IRR) (their long-term investment target)

Multiples are simply the outward expression of these deeper financial calculations.

If the lease is strong — higher rent, long term remaining, favorable amendments, predictable escalation — investors can justify a lower cap rate or a stronger IRR model, which results in a higher multiple for the property owner.

Why Your Number Moves Up or Down

Different buyout groups have different underwriting targets, but most operate within familiar ranges:

Cap rate targets: 6%–9%

IRR targets: 7%–12% over time

If the lease looks safer and more durable, buyers accept lower risk and therefore offer higher multiples.

If the lease carries risk — short term, weak escalators, termination language, or market redundancy — they tighten underwriting and reduce the multiple accordingly.

“Multiples tell you the price.

IRR and cap rates determine the price.”

Your actual valuation depends on carrier type, escalators, lease term, amendments, tower type, market density, and termination language.

Wireless leases don’t remain static. Even strong, long-standing sites can lose value as technology, carrier strategy, and network density evolve. These shifts often happen behind the scenes, leaving property owners unaware that the financial profile of their lease is gradually weakening.

Here are the most common factors that reduce lease value:

Why Your Lease Value May Drop Over Time

Lease termination rights: Most carrier and tower company agreements allow early termination with short notice, which limits long-term security.

Rent reduction or renegotiation attempts: Carriers increasingly push for amendments that lower rent or freeze escalators.

Equipment consolidation or relocation: Multi-carrier sites can lose tenants as networks consolidate and carriers share infrastructure.

5G densification reducing macro tower dependence: As carriers build more small cells and infill coverage, tall macro sites can become less essential.

Spectrum reframing eliminating older tower sites: When legacy technology is retired, some towers simply aren’t needed.

Competition from nearby locations: New towers or rooftops with better line-of-sight can reduce the strategic importance of your site.

What This Means for You

A buyout removes these uncertainties by converting future risk into guaranteed capital today. Instead of relying on decades of rent that may change — or disappear entirely — a buyout secures your lease’s full value upfront, regardless of how the wireless industry evolves.

When It Makes Sense to Sell Your Lease

For many property owners, selling a wireless lease isn’t just about cashing out — it’s about eliminating uncertainty and unlocking the full value of an asset that may or may not continue forever. A buyout can be the right move when your financial goals, property plans, or risk tolerance align with capturing value today instead of waiting decades for rent.

Here are the most common situations where selling makes strategic sense:

You want a guaranteed, risk-free lump sum - A buyout converts a long-term rent stream into immediate capital you can use today — no future carrier negotiations, no risk of termination, and no surprises.

You inherited the lease and prefer simplicity - Many owners choose a buyout to avoid dealing with amendments, billing questions, and technical language tied to the lease.

You see signs of possible termination - Network consolidation, small cell build-outs, or changing carrier priorities can put certain sites at risk. Selling protects you from a potential loss of income.

Your tenant requests amendments or rent changes - Requests for “upgrades,” additional equipment, or rent freezes can indicate shifting carrier strategy. A buyout captures value before the lease is modified.

You want financial flexibility - A buyout provides liquidity for life events, estate planning, retirement strategies, or re-allocating capital where it matters most.

You want to invest in higher-return opportunities - Real estate projects, business expansion, paying down debt, or market investments often produce returns well above the 6–9% cap rate a tower lease typically represents.

Selling is most compelling when certainty, liquidity, or strategic reinvestment outweigh the value of long-term monthly rent. A buyout allows you to control the timeline — instead of waiting decades for the lease to play out.

What Happens After You Sell Your Lease?

A buyout doesn’t change how you use your property — it simply transfers the future rent stream tied to the wireless lease. You keep full ownership of your land, building, or structure, and the buyer steps into your place as the party receiving the rent.

Here’s what typically happens after closing:

You continue owning and using your property normally. Nothing changes regarding access, operations, or daily use. Your land or building remains fully yours.

The buyer begins receiving future rent payments. They take over the financial portion of the lease and collect payments directly from the tenant.

An easement or assignment is recorded. This recorded document protects the buyer’s rights to the lease income and ensures long-term clarity for all parties.

You have no ongoing obligations. Once the transaction closes and funds are wired, your participation is complete. There are no future responsibilities, approvals, or negotiations required.

You receive a clean one-time payout. Your buyout is finalized as a single lump-sum deposit, usually within 30–60 days from agreement.

For most owners, the process is simple, fast, and designed to eliminate ongoing uncertainty while providing immediate financial flexibility.

Who Buys Cell Tower Leases?

Tower Companies

Strategic buyers seeking long-term site control.

Aggregators / Middlemen

Short-term buyers who resell leases to larger instituations

Telecom Investment Firms

Experts focused exclusively on wireless lease assets.

Private Equity Funds

Strategic buyers seeking long-term site control.

When evaluating a buyout offer, the first question you should ask is: “Who is the buyer?”

Different groups have different motivations, risk tolerances, and pricing strategies — which is why the same lease can receive dramatically different offers.

Knowing who the buyer is—and how they evaluate your lease—is the first step toward negotiating a fair, market-driven buyout offer.

Buyer Type

Best At

Weak At

Paying top multiples

Slower review cycles

Telecom-specific nuance

Lowest valuations

Buyer Strengths & Weaknesses

Long-term control

Accurate underwriting

Stable payouts

Fast offers

Tower Companies

Telecom Firms

Private Equity

Aggregators

What Happens After You Sell Your Lease?

A buyout doesn’t change how you use or enjoy your property — it simply transfers the financial rights tied to the wireless lease. You continue to own the land or building, while the buyer steps into your place to receive rent from the tenant.

Here’s what typically happens after closing:

You continue to own and use your property normally - Nothing about your daily operations changes. The tower or rooftop equipment remains exactly where it is.

The buyer begins receiving future rent payments — They replace you as the payee under the existing lease, with no interruption to tenant operations.

An easement or assignment is recorded — This document protects the buyer’s rights and ensures clean, long-term clarity for lenders, title companies, and future owners.

Your obligations end once the transaction closes — You have no further responsibilities, approvals, or negotiations tied to the lease after the closing date.

You receive a one-time lump-sum payment — Funds are typically wired within 30–60 days of signing, depending on the buyer and lease structure.

A buyout is designed to be a clean, simple, one-time transaction that removes future uncertainty.

FAQ: Cell Tower Lease Buyouts

-

Most buyouts close within 30–60 days. The timeline depends on the buyer’s due diligence process, your lease structure, and how quickly documents can be reviewed.

-

No. You keep full ownership of your land or building. A buyout only transfers the lease rights and future rent, not your underlying property.

-

Usually no. Most leases allow you to transfer rent rights without tenant approval.

If your agreement includes a Right of First Refusal (ROFR) or a Consent to Assignment clause, we simply notify the tenant or obtain their sign-off as required. This is a routine part of the process, and we handle all communication and documentation to keep everything smooth and compliant. -

Only if the existing lease allows it. A buyout does not expand the carrier’s rights - it simply transfers the current terms to a new party.

-

Almost all wireless leases allow termination with 30–90 days’ notice. This risk is already priced into valuations and is a key reason many owners choose a buyout.

-

Yes. You can sell or refinance your property normally. The easement simply transfers to the new owner, just like any recorded agreement.

-

Buyouts typically do not increase property taxes, because the transaction is tied to lease rights - not the value of your land or building. Your tax advisor can confirm for your specific jurisdiction.

-

Each buyer has different:

Risk tolerance

IRR targets

Cap rate expectations

Long-term strategies

Appetite for amendments

View of termination risk

This is why the same lease can generate dramatically different offers.

-

Multiple tenants often increase value. Buyers can purchase one, some, or all lease interests depending on your goals.

-

No. The buyer typically notifies the tenant after closing and then begins receiving rent directly. There is no involvement required on your part.

-

An easement is a recorded legal document that preserves the buyer’s rights to the lease income and equipment space. It does not change your ability to use, sell, or develop the rest of your property (outside the defined area).

-

Yes - and you should. Buyout values often vary widely across buyers (sometimes 20–40% difference) depending on underwriting assumptions and risk evaluations.

Connect With Phone Booth Capital Today

Unlock the true value of your cell tower lease with expert guidance